The delinquency rate for U.S. residential mortgages rose slightly in the first quarter of 2025. This was partially driven by an uptick in conventional loan delinquencies and rising foreclosure inventory, particularly among loans backed by the U.S. Department of Veterans Affairs (VA).

The Mortgage Bankers Association (MBA) reported Tuesday that the seasonally adjusted delinquency rate for mortgages on one- to four-unit properties increased to 4.04% of outstanding loans in the first quarters. That’s up 6 basis points from the prior quarter and 10 bps higher than the same period last year.

The percentage of loans entering foreclosure also edged higher — rising by 5 bps to represent 0.2% of outstanding loans during the first quarter.

“There were mixed results for mortgage performance in the first quarter of 2025 compared to the end of 2024. Delinquencies on conventional loans increased slightly, while mortgage delinquencies on (Federal Housing Administration) and VA loans declined,” said Marina Walsh, MBA’s vice president of industry analysis.

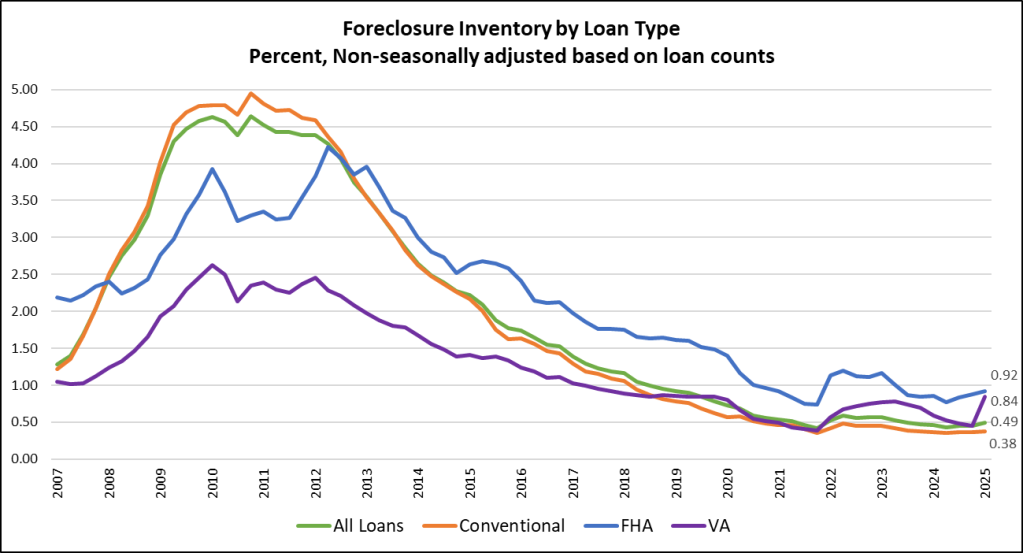

“Foreclosure inventories increased across all three loan types, and particularly for VA loans. Despite certain segments of borrowers having difficulty making their mortgage payments, the overall national delinquency and foreclosure rates remain below historical averages for now.”

VA loans saw the sharpest gain in foreclosure activity.

“The percentage of VA loans in the foreclosure process rose to 0.84 percent, the highest level since the fourth quarter of 2019,” Walsh said. “The increase from the previous quarter marks the largest quarterly change recorded for the VA foreclosure inventory rate since the inception of MBA’s survey in 1979.”

The rise in VA foreclosures can be attributed in part to the expiration of a temporary moratorium, she added.

“A voluntary VA foreclosure moratorium was in effect through the end of 2024 to allow time to implement the Veterans Affairs Servicing Purchase Program,” Walsh said. “That program has since ended without a replacement loss mitigation option approved by Congress. Further increases in the foreclosure rate could result if economic conditions worsen and loan workout options are unavailable.”

Breakdown by stage and loan type

In more detailed findings from MBA’s quarterly survey:

- The 30-day delinquency rate rose 11 bps to 2.14%.

- The 60-day delinquency rate declined by 3 bps to 0.73%.

- The 90-day delinquency rate declined by 2 bps to 1.17%.

By loan category:

- Conventional loans saw their seasonally adjusted delinquency rate rise 8 bps to 2.7%.

- FHA loans posted a decline of 41 bps to 10.62%.

- VA loans saw a decrease of 7 bps to 4.63%.

On a year-over-year basis:

- Delinquencies increased 8 bps for conventional loans

- Increased 23 bps for FHA loans

- Decreased 3 bps for VA loans

Foreclosure and serious delinquency rates

At the end of Q1 2025, 0.49% of loans were in the foreclosure process — up 4 bps from the prior quarter and up 3 bps from from the same period a year ago.

The seriously delinquent rate — loans 90 or more days past due or already in foreclosure — stood at 1.63%. This represents a 5-bps decrease from Q4 2024 but a 19-bps increase from a year earlier.

- Conventional loans saw a 3-bps quarterly decline but a 5-bps annual increase.

- FHA loans dropped 14 bps from last quarter but were up 80 bps year over year.

- VA loans declined 7 bps from the prior quarter and increased 50 bps from a year ago.

The five states that experienced the most significant annual increases in overall mortgage delinquencies were:

- Florida (+46 bps)

- South Carolina (+26 bps)

- Georgia (+25 bps)

- Delaware (+25 bps)

- Wyoming (+24 bps)

First Time Home Buyer FAQs - Via HousingWire.com