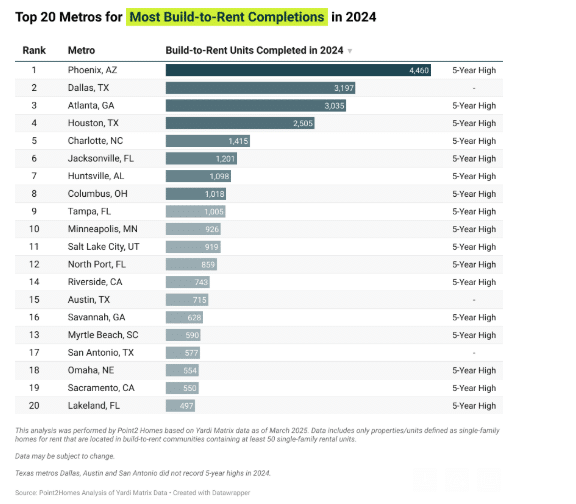

Myrtle Beach is among the fastest-growing build to rent markets in the country, adding 590 new single-family rentals last year.

One key example is the J1 student housing, being constructed by the City of Myrtle Beach on Burroughs and Chapin leased land.

Here are some of the main highlights:

- Explosive 5-Year Growth: Over the past five years, Myrtle Beach added 1,391 new build to rent homes, increasing its single-family rentals inventory by a staggering 732% compared to 2019 — one of the steepest growth rates of any of the metros analyzed.

- South Carolina’s build to rent Momentum: Myrtle Beach is part of a larger state-level trend. Nearby Greenville added 1,904 new units over the past five years — a 750% increase from 2019 levels.

- Continued Expansion Ahead: The entire build to rent sector reached a historic high with 39,000 new units completed in 2024, a 15.5% increase from 2023 and ten times higher than 2015. This expansion is set to continue, with nearly 110,000 single-family rental homes currently in the pipeline across the country.

- Myrtle Beach will remain a key player, with 668 additional homes planned or currently under construction.

While the rise of build to rent (BTR) homes can impact the housing market, it’s not a definitive cause of increased prices for average home buyers, but rather a complex issue with various factors at play.

Here’s a more detailed breakdown on Build To Rent influence on pricing:

Increased Demand for Rental Properties: The build-to-rent sector meets a rising need for rental accommodations, particularly single-family houses, amid escalating home purchase costs.

Impact on Home Prices: The increase in build-to-rent properties might reduce the number of homes for sale, potentially causing prices to rise for regular homebuyers.

Homeownership Premium: The difference between the monthly mortgage payment for a newly bought house and rent has increased, resulting in higher costs for owning a home compared to renting.

Other Factors Affecting Home Prices: Home prices can be influenced by various factors such as interest rates, economic conditions, and overall market demand.

Build to rent as a Solution: There are those who claim that build-to-rent homes could alleviate the housing shortage and offer a rental alternative similar to owning a home.

Property Values: An excess of rental homes in an area might lead to property values remaining stagnant or decreasing, since renters may not upkeep residences as meticulously as homeowners.

BTR as an Investment: Developers are increasingly adopting the build-to-rent strategy, constructing communities of single-family homes for rental purposes instead of sales.

Rental Market: There is a high demand in the rental market, leading to a rise in average rental prices for single-family homes.

You can check out the full report here: https://www.point2homes.com/news/research/build-to-rent-completions-reach-historic-high.html.

Local News Via - MyrtleBeachSC.com