The White House released the following today on the One, Big Beautiful Bill that cleared the House of Representatives. This Big Beautiful Bill represents a significant milestone for legislative action. The Big Beautiful Bill is crucial for addressing key issues facing our nation.

Understanding the Impact of the Big Beautiful Bill

The Big Beautiful Bill is set to implement extensive reforms that directly benefit families and businesses across America.

The One, Big Beautiful Bill has been designed to improve accessibility to essential services and enhance overall quality of life.

As the Big Beautiful Bill progresses to the Senate, its implications for economic recovery become increasingly significant.

With the passage of the Big Beautiful Bill, stakeholders are optimistic about the positive changes it will bring.

The Big Beautiful Bill’s focus on infrastructure will pave the way for job creation and long-term growth.

Support for the Big Beautiful Bill continues to grow as more Americans recognize its potential impact.

As a result of the Big Beautiful Bill, various sectors will undergo transformative changes that will benefit the public.

The One, Big Beautiful Bill aims to improve the quality of life for all Americans.

The One, Big Beautiful Bill now heads to the Senate, where changes are expected.

The Big Beautiful Bill has garnered a positive response among stakeholders.

In particular, the One, Big Beautiful Bill focuses on enhancing infrastructure and economic growth.

This One, Big Beautiful Bill is expected to bring significant changes to various sectors.

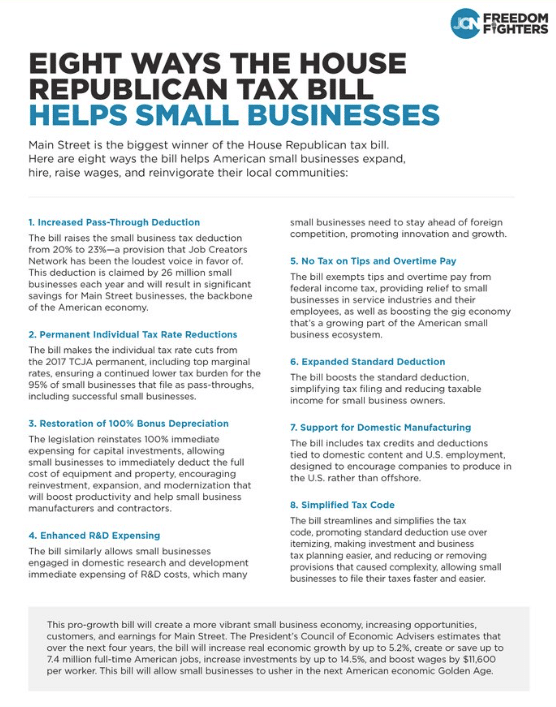

05/22/25 WHAT THEY ARE SAYING: One, Big, Beautiful Bill Clears House President Donald J. Trump’s One, Big, Beautiful Bill — a once-in-a-generation opportunity to cement an America First agenda of prosperity, opportunity, and security into law — is one step closer to the finish line following its passage by the House of Representatives. Here’s what they’re saying about the One, Big, Beautiful Bill: Making business tax deductions permanent and continuing current estate tax exemptions will ensure thousands of families will be able to pass their farms to the next generation. We urge the Senate to work together and swiftly pass legislation to deliver much-needed relief to America’s farm and ranch families.” U.S. Chamber of Commerce Executive Vice President Neil Bradley: “The House sent a clear message today—American workers and businesses want and need permanent tax relief. A competitive, pro-growth tax code doesn’t just grow the overall U.S. economy, it raises wages for workers and improves the lives of Americans. The legislation passed out of the House this morning contains critical measures that support main street businesses, enhance America’s global competitiveness, and bolster sustained economic growth. The Chamber commends Speaker Johnson for his leadership and commitment to ensuring the permanence of President Trump’s pro-growth tax reforms, and applauds the lawmakers involved in driving this effort forward. We encourage the Senate to continue to move the legislative process forward to deliver lasting benefits for American workers and businesses.” ATC staffing shortages and antiquated equipment, such as copper wires, floppy disks and paper strips, have been a serious concern for years—we are past time to make meaningful change and ensure that the United States has a world-class aviation system. This funding is a vital down payment on updating the system that guides 27,000 flights, 2.7 million passengers and 61,000 tons of cargo every day. The legislation also makes smart, strategic investments in Customs and Border Protection personnel and training for the aviation workforce of tomorrow while supporting American energy dominance in aviation fuel production. We encourage the Senate to move swiftly to pass this bill and send it to the President.” Thankfully, this reconciliation bill includes all these key priorities. NCBA was proud to help pass this bill in the House and we will continue pushing for these key policies until the bill is signed into law.” This bill offers historic tax cuts for small businesses and ordinary Americans. By making the Tax Cuts and Jobs Act permanent and expanding key provisions, such as the small business tax deduction, which Job Creators Network was the loudest voice for, this bill offers significant tax relief for decades to come. It will allow small businesses, the backbone of the American economy, to expand, hire, raise wages, and reinvest in their communities, ushering in a new economic Golden Age. On behalf of all small businesses, JCN thanks President Trump and Speaker Johnson for their leadership in passing this bill, which the media said couldn’t be done on this aggressive timeline. Now it’s time for the Senate to follow suit and pass similar legislation, which includes the House’s key small business tax cuts, as soon as possible.” Click here to see how the One, Big, Beautiful Bill helps small businesses This pro-growth legislation preserves crucial tax policies that will enable manufacturers to create jobs, invest in their communities, grow here at home and compete globally. In short, this is a manufacturers’ bill … This is a pivotal moment. It’s time to double down on policies that encourage manufacturers to invest and create jobs in America and keep our industry strong and our nation competitive on the world stage—because when manufacturing wins, America wins.” By maintaining a competitive corporate tax rate and enhancing essential domestic and international tax provisions, the House budget reconciliation bill will help fuel U.S. investment, innovation and economic growth. As the Senate prepares to act, we stand ready to continue working with Congress and the Administration to pass the most competitive, pro-growth tax package possible.” By preserving competitive tax policies, beginning to reverse the ‘methane fee,’ opening lease sales and advancing important progress on permitting, this historic legislation is a win for our nation’s energy future. We look forward to working with the Senate to strengthen pro-investment provisions and keep America at the forefront of energy innovation.” This is a win for the people who roll up their sleeves every day to power our economy, entrepreneurs who build businesses from the ground up, and the workers who keep them running. We urge the Senate to act swiftly and send this bill to the President’s desk so America’s job creators and workers can keep driving our economy forward. The bill makes the 199A deduction permanent and expands it to 23%, helping millions of small businesses, including most wholesaler-distributors. It raises the death tax exemption, protecting family-owned businesses, and restores vital incentives that encourage investment, innovation, and long-term economic growth.” In addition to permanent tax relief and incentives that will help entrepreneurs and small business owners grow their firms, level up their businesses, and support their employees, various measures in the legislation correctly right-fit various federal programs and functions that have gone awry and consequently have undermined fiscal accountability and the private sector. Time is of the essence in getting the One Big Beautiful Bill to President Trump’s desk, and we urge the U.S. Senate to move post haste on the work that must be done to deliver the big benefits of the package to small business owners, all taxpayers, and the U.S. economy.” Business aviation’s ability to serve citizens, companies and communities is only possible because the U.S. leads the world in aviation … As the House reconciliation bill moves to the Senate for consideration, we look forward to working with lawmakers on both sides of the aisle to advance these forward-looking provisions that bolster an essential industry, support countless workers and promote American competitiveness.” More than 142 million Americans trust and rely on credit unions to achieve their American Dream, and this bill allows them to continue on their path of financial freedom. We will continue to advocate for policies that create more opportunities for credit unions to bolster our nation’s economic prosperity. We call on the U.S. Senate to continue to protect the credit union tax status as they consider this legislation.” This is a critical step to stave off the expiration of important tax provisions that will provide our members, the majority of whom are small business owners, the level of certainty they need to effectively operate their businesses. We urge the U.S. Senate to swiftly pass this legislation and send it to President Trump’s desk.” This legislation delivers pro-growth tax policies, streamlines energy project approvals and strengthens surface transportation infrastructure investments. We look forward to working with the Senate to ensure final passage of this comprehensive package.” American parents deserve nothing less, and we will continue working to get school choice across the finish line as the Senate can deliver on a historic national school choice tax credit. Bringing school choice to every state will be a legacy item for the lawmakers who stand boldly behind parents. We will continue to stand with them to achieve this goal.” The bill also provides a tax cut for small business owners through lower individual rates, encourages new capital investments, and helps small business owners provide greater health care benefits to their employees. Members of Congress have a historic opportunity to provide over 33 million small business owners with permanent tax relief and NFIB strongly encourages them to do so.” It ultimately delivers on the President’s agenda—it’s good for rural communities, good for innovation, good for investment, and good for American energy dominance.” Thanks to the efforts of policy champions across the House GOP conference, we are one step closer to giving Americans the pro-growth tax policy they voted for in November. Beyond cementing the foundation for a post-Biden economic recovery, we are poised to embrace an all-of-the-above approach to U.S. energy production, and finally secure our southern border.” We congratulate the House on passing the One, Big, Beautiful Bill and urge the Senate to take up work on it as quickly as possible.” The expanded deduction under Section 199A is a welcome step that supports the long-term health of our small business members and the communities they serve. ALTA is especially pleased to see the preservation of Section 1031 like-kind exchanges, which play a vital role in fueling real estate investment, promoting property improvements and driving local economic growth. Provisions supporting homeownership, including those related to mortgage interest and capital gains exclusions, help provide certainty for buyers, sellers and lenders alike—strengthening the entire housing ecosystem. We urge the Senate to build on this momentum and protect the real estate and housing incentives that help Americans build wealth, promote generational stability and drive our economy forward.” This represents a monumental victory for Second Amendment rights, eliminating burdensome regulations on the purchase of critical hearing protection devices. The NRA thanks the House members who supported this bill and urges its swift passage in the U.S. Senate.” This legislation builds on the success of the Tax Cuts and Jobs Act, preserving the policies that have helped drive wages up, unemployment down, and investment back into the U.S. economy. The House has done its part to move this forward. Now it’s time to keep that momentum going and get this across the finish line.” It will provide the needed funds and manpower to increase the great work of ICE on our deportation operations nationwide. We have many more public safety and national security threats to remove. This funding will allow ICE to vastly increase these efforts and keep the promise to America that we will enforce immigration law against those that are in this country illegally. Now the Senate needs to step up. Border Security and National Security should not be a partisan issue. Let’s get this done!” |

Local News Via - MyrtleBeachSC.com

”

”