In a press release today, President Donald Trump stated:

“Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the tariffs charged to China by the United States of America to 125%, effective immediately. At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable.”

“Conversely, and based on the fact that more than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR, to negotiate a solution to the subjects being discussed relative to Trade, Trade Barriers, tariffs, Currency Manipulation, and Non Monetary Tariffs, and that these Countries have not, at my strong suggestion, retaliated in any way, shape, or form against the United States, I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately. Thank you for your attention to this matter!”

Understanding Tariffs and Their Impact on Trade

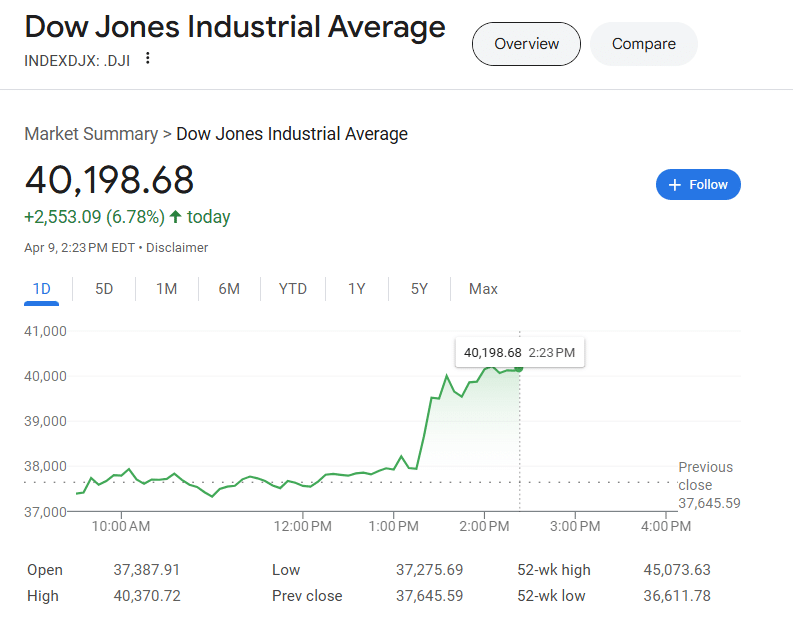

Trump’s announcement has set off a ripple effect throughout various sectors of the economy causing the Dow Jones to momentarily soar. For instance, industries such as steel and aluminum may experience a surge in demand as domestic manufacturers gain a competitive edge. However, retaliatory tariffs were previously implemented by China to 84%, escalating tensions and uncertainty in economic relations.

President @realDonaldTrump once again proves he’s the master of the deal!

Today’s 90-day tariff pause, which slashed rates to 10% for most nations while bringing many others to the table, shows his unmatched ability to negotiate from strength. It has driven American and global…

— Elise Stefanik (@EliseStefanik) April 9, 2025

Ultimately, the consequences of these tariffs will extend beyond immediate economic impacts. They will influence relationships between countries, affect diplomatic negotiations, and potentially reshape the global economic landscape as nations respond to these changes. Analysts will be examining trends in trade balances, currency fluctuations, and shifts in global supply chains as the situation develops.

At this point, China and President Trump are both unwilling to give in. Nevertheless, economists highlight that the United States is better positioned to engage in a prolonged tariff dispute with China.

In light of Trump’s recent tariff increase, it’s crucial to examine how various stakeholders are responding. Businesses that rely on imported goods may face challenges in their supply chains, leading to increased operational costs. Conversely, American manufacturers could benefit significantly from reduced competition. Additionally, consumers may find themselves paying more for certain products as companies pass on the costs of tariffs. This situation calls for careful monitoring of price changes in the marketplace.

The Dow Jones responded with a 2,553.09 immediate jump after days of declines. This tariff raise was coupled with a 90 day tariff pause on those nations willing to negotiate with the Trump Administration for free and fair trade.

Local News Via - MyrtleBeachSC.com