As the longest standing, locally owned news outlet in the area, MyrtleBeachSC News is qualified to lay out why businesses are not investing in Myrtle Beach.

There are numerous factors influencing why businesses are hesitant to consider investing in Myrtle Beach.

Investing in Myrtle Beach requires understanding the local market dynamics, tourism, the city’s history, and community needs.

Myrtle Beach Mayor Brenda Bethune told locals and tourists, after last Saturday’s Ocean Boulevard shooting, “So until we realize that people need to reinvest and invest in the right types of businesses in Myrtle Beach, we are not going to change the clientele.“

Fraternalism in the city affects potential investors considering investing in Myrtle Beach.

Understanding the challenges of investing in Myrtle Beach can lead to new opportunities, but the challenges are real.

Why Businesses Are Not Investing in Myrtle Beach: Fraternalism

Investing in Myrtle Beach is a crucial step for revitalizing the community and economy.

Preferred businesses in the Arts and Innovative District in Myrtle Beach receive corporate incentives. Despite those incentives, these businesses struggle. Other investors can’t get the same opportunity for competing dollars and they choose not to pay a higher price for investment. Therefor they do not invest here.

This investment landscape requires that stakeholders focus on competitive business practices when investing in Myrtle Beach.

One case in point is the recently closed Le Manna Breadcompany. The city bought the building Le Manna Bread operated in. The city put a lot of money in the run down space and then gave Le Manna Bread almost $150,000 in upgrades to build out the space.

Le Manna Bread closed just over one year after opening. After failing, Le Manna Bread was provided $125,000 outlay by the city to buy back their furniture and equipment. As background, restaurant equipment sells for pennies on the dollar at auction when any business shuts down abruptly. The equipment is typically liquidated.

The City of Myrtle Beach is charging Winna’s Kitchen, the new tenant just $500/month for the furniture, fixtures & equipment (FF&E) rental portion of the lease. Winna’s Kitchen moved from one space in the Arts and Innovation District to the Le Manna Bread location in the same block.

There are still untapped opportunities for investing in Myrtle Beach that align with community interests, but the city has proven a poor real estate holder.

The future of investing in Myrtle Beach depends on how these challenges are addressed.

Payback, to the city, for furniture, fixtures & equipment will be reached in just under 21 years on the recent $125,000 outlay by the city to the failed Le Manna Bread.

Potential investors should consider the risks before investing in Myrtle Beach.

This is a paltry financial return for the city and nothing but continued corporate welfare in the Arts and Entertainment District. But oh wait, in Jan 2027, Winna’s Kitchen can buy the building and the FF&E at the then fair market value which will be pennies on the dollar compared to what the city has invested in that space.

Le Manna Bread broke their lease. The city should have taken the equipment to cover their losses on the broken lease regardless of the owner’s poor health conditions. Free market commercial leasers would never pay for the FF&E on a broken lease.

In January 2027, Winna’s Kitchen can buy it for “peanuts” and guess what, they handed this sweetheart deal to a business known very well Mayor Brenda Bethune.

This sweetheart deal was never made available through a competitive bid process to the broader general public with full transparency. One last item, no legitimate appraiser would ever value the Le Manna FF&E at $125,000. Did the city require an appraisal? Was an appraisal even done?

Investing in Myrtle Beach presents unique challenges, but it also will bring great rewards if navigated ethically.

Investors have been frustrated by the city’s unintended impact when investing in Myrtle Beach.

It’s evident that the city’s business choices are lacking. Markets operate dynamically and efficiently, and investors recognize this, choosing not to invest in other areas of the city, when they can find such lucrative deals in the Arts and Innovation District.

Despite setbacks, the interest in investing in Myrtle Beach remains strong among forward-thinking leaders like the newly hired C.E.O. of the Myrtle Beach Area Chamber of Commerce.

WHY THE FIRST PRESBYTERIAN PURCHASE/ROAR INVESTMENT DEAL FAILED?

City leaders made a big deal about a potential investment of a new venue called ROAR. ROAR LLC from Raleigh purchased the old First Presbyterian Church desiring to convert it to a 1920’s venue.

In 2023, the headlines read that the new venue, ROAR, will transform the abandoned, historic First Presbyterian church on North Kings Street, into a 1920s-themed attraction.

ROAR was anticipated to operate as both a bar and a bowling alley, with the possibility of including a beer garden as well. The Mayor’s husband, Brown Bethune, was the closing agent on the sale.

The church was purchased. As the new investors began the conversion process they noted they could not get rid of the homeless people who were continually living in the old church.

The city felt that the homeless issue was now ROAR’s problem. As per Myrtle Beach Police Chief Amy Prock’s statement this week, “Crime is a shared responsibility.”

This is the city’s motto to any new, outside investor.

Last week, a local showed us a place where homeless people are still staying. The interior was in disarray, with falling plaster, missing ceiling tiles, leaks in the roof, and signs of mold and mildew. It’s a disaster.

Roar, LLC was a very serious and savvy investor who chose to quit digging an endless whole.

Every missed investment in Myrtle Beach contributes to the city’s lack of growth and sustainability.

ESA FITNESS – Yet Another Arts and Innovation Failure

Investing in Myrtle Beach would lead to significant economic improvements for the area.

On April 1st, Assistant City Manager Brian Tucker sent a letter to ESA Fitness, directing them to leave the property by April 14th. The business had leased from the city and moved into the Arts and Innovation District. ESA Fitness owes the City of Myrtle Beach $20,156.69 in arrears for “below the market rent rates” to the city.

ESA Fitness has now left the city owned building. We are told another inside opportunity is in the works. This was yet another city subsidized business in that area that closed within one year.

Short Term Rentals – Inconsistent reinforcement of city laws

Transparency and collaboration are key factors for successful investing in Myrtle Beach.

Investing in Myrtle Beach will require consistent laws to address existing challenges.

In December 2024, the City of Myrtle Beach prohibited the transformation of short-term rentals into long-term rentals for properties located on Ocean Boulevard.

The city now is faced with a lawsuit regarding the Sand Castle South property at 2207 South Ocean Blvd. in Myrtle Beach. Allegedly, the city’s moratorium on transitioning short-term rentals to long-term usage in April 2024 hindered the firm from securing a long-term rental business license for the Sand Castle South.

However, this was not so for a 1960’s built hotel formerly known as the Waikiki Village.

Waikiki Village on Ocean Boulevard used to be a motel, but it has been converted into The Edge Apartments, which now serves as a workforce housing building. This former hotel is allowed to do long term rentals.

The Waikiki Village/Edge Apartments sit at 1500 S Ocean Blvd, a mere 12 blocks from the SandCastle South on Ocean Boulevard.

“We want to keep this building here forever, we don’t want it to get torn down,” said Jeff Prioreschi, Director of Acquisitions for GBX Group, which bought the property of which the city allowed the conversion to long term rentals.

“I was having breakfast with a gentleman, Clay Brittain, with the Brittain Resorts about two years ago, and he said, ‘Jeff, we really need workforce housing in Myrtle Beach,’” said Prioreschi. “A light went off in my head. I’m thinking, ‘well, our property, Waikiki Village, might meet that demand.’”

As the city selectively changed it’s own zoning ordinances, the idea for The Edge Apartments emerged, consisting of approximately 40 units offered at affordable rates, conveniently located on Ocean Boulevard across from the beach.

Investors do not like laws for me, but not for thee.

LAND LOCKED – PROPERTIES NO ONE CAN BUY

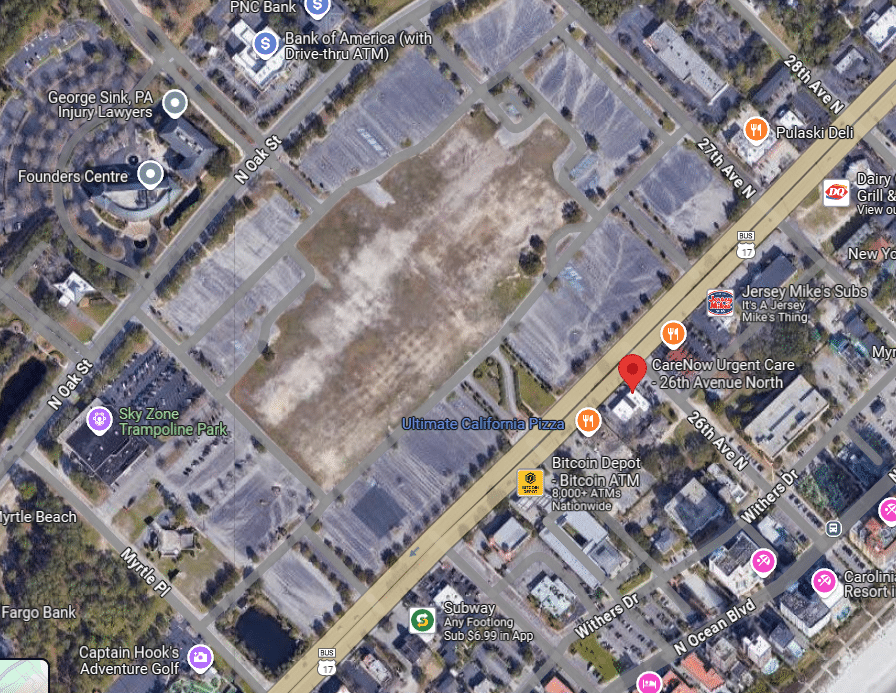

Chapin Company and Burroughs and Chapin Company own three important land parcels that the city cannot purchase or force the companies to sell. Due to the properties being purchased around 1911, any sale would result in capital gains taxes, making such a deal unfeasible.

The revitalization of downtown relies on the city having a skilled negotiator who can work closely with these businesses. Investing in Myrtle Beach on these properties will require a skillful lease deal maker. The city continues to prove it makes poor business decisions.

Mayor Bethune is frequently labeled as aggressive and causing conflicts.

Local News Via - MyrtleBeachSC.com